One of the great things about Club Carlson is how easy their points are to accrue. The Club Carlson Visa offers 10 points per dollar for purchases at Club Carlson hotels like Radissons, Radisson Blus, Park Inns, and 5 points per dollar everywhere else. The cherry on top of this was that when you have the US Bank Club Carlson Visa and have an award stay of two nights or more, the last night is free. That meant for two people who each had the card, they could make alternating reservations of two nights each and the stay would cost half the points.

One of the great things about Club Carlson is how easy their points are to accrue. The Club Carlson Visa offers 10 points per dollar for purchases at Club Carlson hotels like Radissons, Radisson Blus, Park Inns, and 5 points per dollar everywhere else. The cherry on top of this was that when you have the US Bank Club Carlson Visa and have an award stay of two nights or more, the last night is free. That meant for two people who each had the card, they could make alternating reservations of two nights each and the stay would cost half the points.

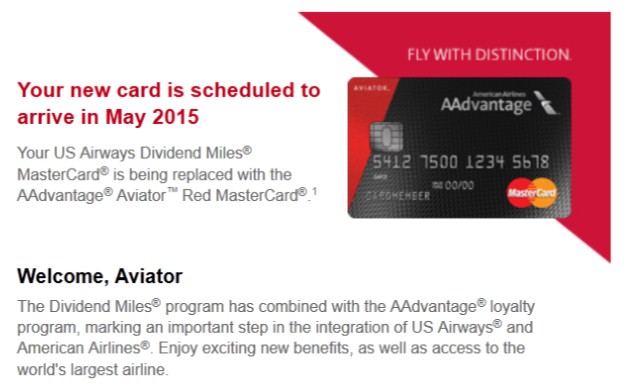

Per Frequent Miler’s post this morning, this benefit is going away. In its place is an offer for a free night each year after spending $10,000 on the card and paying the annual fee of $75.

This is a huge devaluation. I hadn’t even had a chance to take advantage of this benefit and it’s already going away. At the time I made my reservations for our stay at the Radisson Blu Bosphorus, I was not a card member and thus couldn’t take advantage of it.

I’m seriously wondering whether or not I should keep this card once the annual fee comes due. Club Carlson is not my go-to hotel chain and their footprint in North America is pretty small. It’s certainly better overseas but my plans for the next few years include places where I expect I’ll be able to find Hyatt, Marriotts and Hiltons. I will definitely have to reconsider keeping this card.

Update 13:45 CT – Club Carlson has now sent out an email to holders of the Club Carlson Visa further clarifying the changes:

Beginning June 1, 2015, you can earn a Free Night, good at any Carlson Rezidor hotel in the U.S. This Free Night will replace the current Bonus Award Night benefit. Bonus Award Night stays may not be booked after June 1, 2015. You’ll receive the new Free Night award upon renewal of your card after an annual spend of $10,000. Updated program terms and conditions will apply and be available on June 1, 2015.

As a Club Carlson Visa® cardholder you will continue to enjoy the following benefits:

- 10 points per $1 spent in eligible Net Purchases at Carlson Rezidor hotels worldwide – that’s in addition to the 20 points per dollar you earn as a Club Carlson member

- 5 points per $1 spent in eligible Net Purchases everywhere else

- 40,000 renewal bonus points each year when you renew your card by paying the annual fee

- Gold Elite Status – which now includes a dining discount at participating hotel restaurants!

And, to thank you for your continued loyalty, you can earn 30,000 bonus Gold Points® on your next Eligible Stay at a Carlson Rezidor hotel worldwide when you pay with your Club Carlson Visa®. Offer ends August 31, 2015. Terms and conditions apply.*

So spending $10,000 on the card each year will net a free night and at least 50,000 points for that spend. Pay the annual fee of $75 and get 40,000 bonus points. If you were to use the card to load the Target Redcard you could get 90,000 points per year for the annual fee of $75 or $0.000833 per point. Even if you bought Visa gift cards for $10,079, you’d only pay $0.00171 per point. Either way that’s a pretty awesome price for points and a free night to boot.

And if you have a stay at a Club Carlson property before the end of August you’ll get an additional 30,000 points. If you can find a room for $90 those 30,000 points will cost $0.003 apiece. Of course, if the cheapest room you can find is more expensive, the points get more expensive too. Ben values these points at 0.4 cents per point while Brian values them at 0.6 cents each. So if you can get the points this cheaply, it may be worth it to you, especially if you have a great use for them.

Recent Comments